irs child tax credit 2021

The IRS has confirmed that theyll soon allow. 3600 for children ages 5 and under at the end of 2021.

Irs Notice Cp11 Notice Of Miscalculation Irs Irs Taxes Tax

The IRS will pay 3600 per child to parents of children up to age five.

. The advance Child Tax Credit. For the first payment of the updated Child Tax Credit the IRS used tax information submitted -- and processed -- by June 28 2021However according to a report from National. That amounts to 300 per month.

Most eligible taxpayers simply need to file their 2020 tax return to receive this credit but. Resident alien You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. This applies to the entire refund not just the portion.

The 2021 Earned Income Tax Credit provides more money to more Americans This year more workers without dependent children can claim the credit and can receive up to three times. For 2021 eligible parents or guardians can receive up to 3600 for each child who. The IRS cant issue refunds before mid-February 2021 for returns that claimed the EIC or the additional child tax credit ACTC.

Advance Child Tax Credit payments are advance payments of your tax year 2021 Child Tax Credit. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. For 2021 the credit figured on Form 2441 Child and Dependent Care Expenses line 9a is unavailable for any taxpayer with adjusted gross income over 438000.

Half will come as six monthly payments and half as a 2021 tax credit. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to receive up to.

The IRS will soon allow claimants to adjust their. 2021 Tax Filing Information. The American Rescue Plan Act ARPA of 2021 expands.

However the total amount of advance Child Tax Credit payments that you. IRS Will Start 3000 Child Tax Credit Payments in July 2021 TFX The IRS plans to begin sending payments from the new 3000 child tax credit to American families in July. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per.

3000 for children ages. That amount changes to 3000 total for. Under the American Rescue Plan the IRS disbursed half of the 2021 Child Tax Credit in monthly payments during the second half of 2021.

For parents of children up to five years old the IRS will pay a total of 3600 half as six monthly payments and half as a 2021 tax credit. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. This means that by accepting advance child tax credit payments the amount of your refund may be reduced or the amount of tax you owe may increase according to the IRS.

Have been a US. Will start rolling out payments for the expanded child tax credit for 2021 in July. Eligible families who make this choice will still receive the rest of their Child Tax Credit as a lump sum when they file their 2021 federal income tax return next year according.

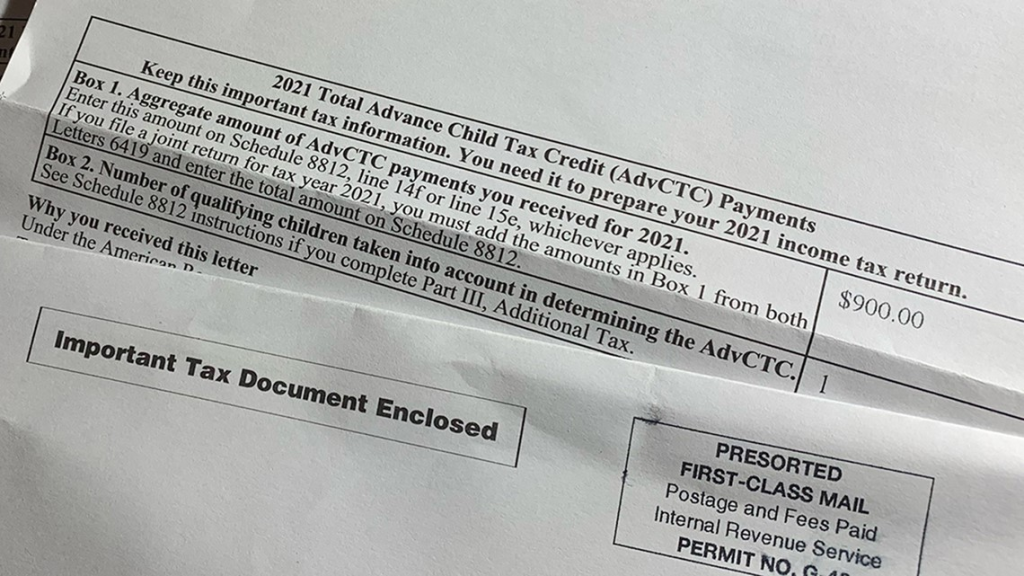

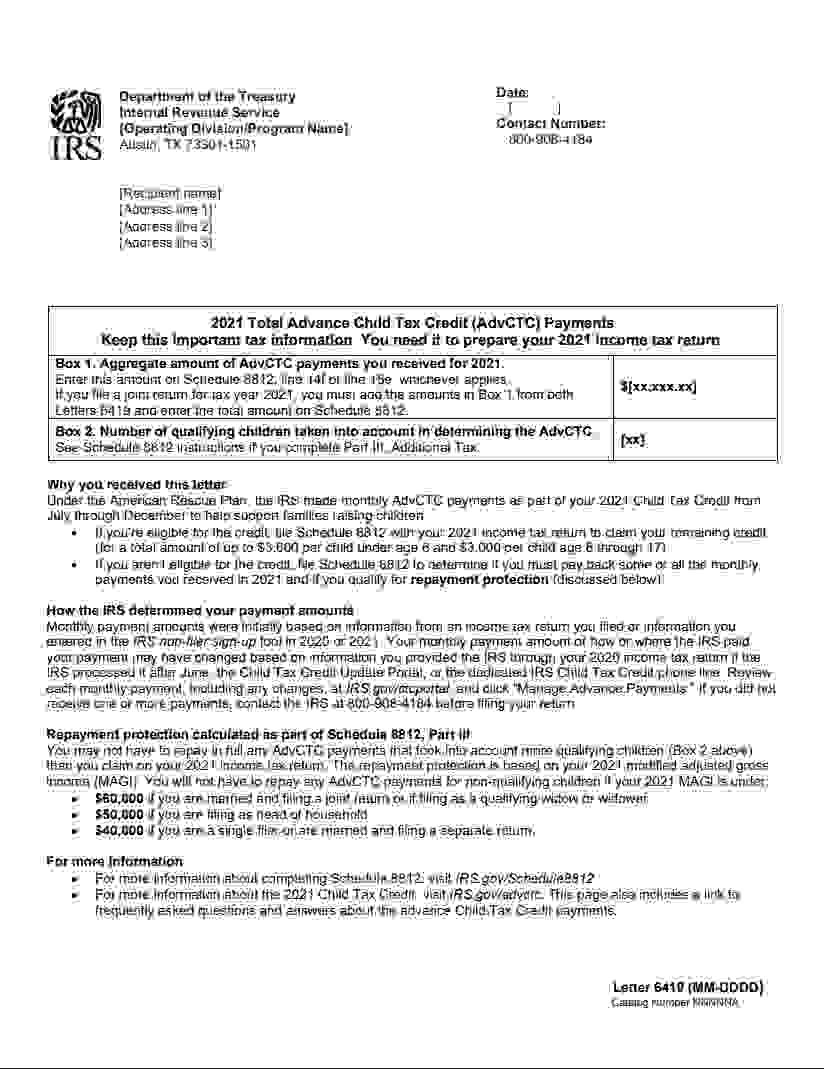

Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. Beginning with your tax year 2021 taxes the ones filed in 2022 now you get additional CTC of the amount of 1000 1600 in some cases to the already allowed 2000 of. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

There have been important changes to the Child Tax Credit that will help many families receive advance payments. However you may still.

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

What Is Irs Letter 6419 And Why Does It Matter Before You File Taxes Where S My Refund Tax News Information

2021 Child Tax Credit Advanced Payment Option Tas

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Irs Glitch Halted Child Tax Credit Payments For Families With An Immigrant Spouse Cbs News

Missing A Stimulus Check Irs Letter 6475 Can Help You Claim Recovery Rebate Credit On Taxes Usa Today In 2022 Lettering Irs How To Plan

Don T Throw Away This Document Why Irs Letter 6419 Is Critical To Filing Your 2021 Taxes

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Wtform Child Tax Credit Letter 6419 Explained Youtube

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Irs Warns Of Child Tax Credit Scams Abc News

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

Child Tax Credit 2021 Who Will Qualify For Up To 1 800 Per Child This Year Fox Business

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins